Global Art Market Report

With a majority of markets around the world struggling, many are cutting back on extravagant spending looking for a place they can safely put their money. A lot of these spending cut backs come in the form of things that are deemed unnecessary such as entertainment and aesthetics. These cutbacks should seemingly have drastic effects on the global art market. However, according to the most recent annual report from Artprice, art sales for 2011 were the highest in history. Forbes even goes as far as to suggest that the global art market may be the world’s strongest economy.

Record Year

Following is what Artprice’s Art Market Analysis had to say about the record year.

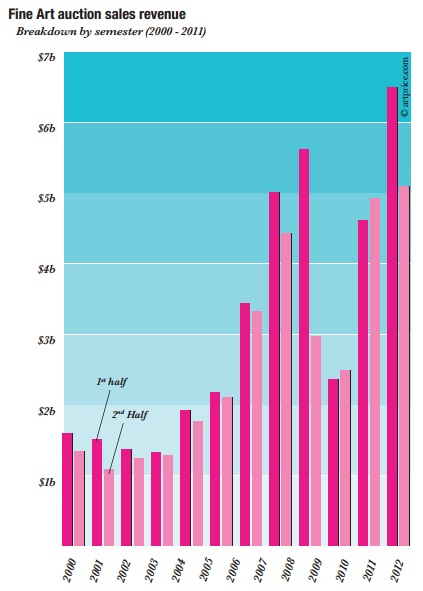

So in spite of the sword of Damocles hanging over the West, art in fact sold better in 2011 than at any other time in history with $11.57 billion in total global annual revenue, up $2 billion versus 2010, which already produced the best performance of the decade. This increase was not solely generated by the Chinese market’s 49% growth compared with 2010; it represented overall growth… including European. Indeed, the leading European auction markets posted strong figures: +24% in the UK ($2.24 billion in 2011 vs. $1.81 billion in 2010), +9% in France ($521 million vs. $478 million in 2010) and +23% in Germany ($213.9 million vs. $174 in 2010). In the Top 5 market places, only the USA contracted with a revenue total of $2.72B, down 3% vs. 2010.

In 2011, the high-end market displayed an extraordinary dynamism. No fewer than 1,675 artworks sold above the $1 million threshold (including 59 above the $10 million threshold) representing a 32% increase of 7-figure (or more) auction sales versus 2010 and an increase of 493% versus the start of the decade! And it comes as no surprise that China posted by far the best national score with 774. Indeed, Hong Kong posted twice as many million-plus results as the entire Euro area! Further evidence of this exceptional health: the year saw no less than 12,400 new auction records for artists (excluding auctions debuts).

Is This Sustainable?

Despite the remarkable numbers the global art market has shown through the worldwide recession, these numbers have been largely backed by the Chinese market. Abigail R. Esman from Forbes believes that this may be dangerous, as she states that the Chinese market may not be as sustainable as many believe.

Personally, I have my doubts as to the sustainability of the Chinese market – as should anyone who is old enough to remember Japan’s hold on the art market during the 1980s. While Chinese Contemporary continues to be a viable niche, it remains mostly local and even the top Chinese artists are burning out, with the exception of extraordinary talents like Cai Guo-Qiang. Despite that, Artprice continues to bet on China, noting that ”if we analyse the Top 10 artists ranked by turnover, the top 2 are Modern Chinese masters whose performance exceed those of Andy Warhol and Pablo Picasso by several tens of millions of dollars.”